Introduction

From stunning national parks to vibrant cities, Canada offers an incredible mix of adventure, culture, and breathtaking scenery. Whether you’re exploring the Rocky Mountains, visiting historic sites, or experiencing Toronto’s food scene, understanding Canada’s currency system ensures a smooth and stress-free trip.

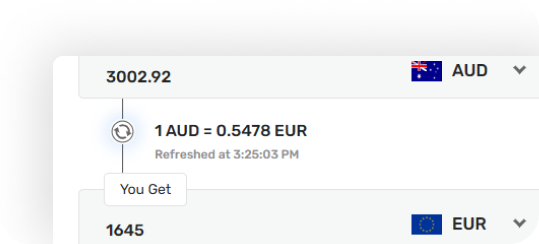

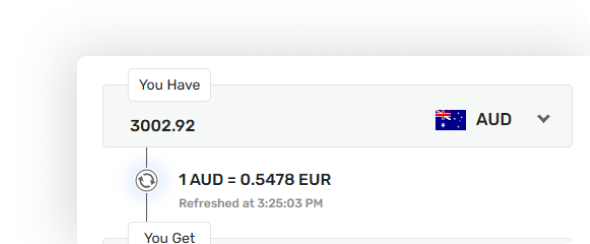

Before traveling, check out Danesh Exchange for competitive exchange rates on Canadian Dollars (CAD)!

Canadian Currency: What You Need to Know

- Canada uses the Canadian Dollar (CAD), represented by $.

- Banknotes come in denominations of $5, $10, $20, $50, and $100, while coins include 5 cents (nickel), 10 cents (dime), 25 cents (quarter), $1 (loonie), and $2 (toonie).

- Credit and debit cards are widely accepted, but cash is still useful, especially for small purchases and rural areas.

Tip: Carry some cash for small transactions—street vendors, farmers’ markets, and parking meters may not accept cards!

Currency Exchange in Canada: Where & How

Many Canadian banks offer competitive rates, but airport kiosks tend to charge higher fees—exchange currency before arriving!

How Long Should You Stay & Budgeting for Your Trip to Canada

Canada offers world-class experiences, whether you’re visiting for a short trip or a cross-country adventure. Here’s what to expect:

Short Trip (3–5 Days)

Budget: $800–$2,000 total

- Best for Toronto, Vancouver, or Montreal.

- Focus on sightseeing, shopping, and food experiences.

- Savings Tip: Opt for public transport instead of taxis in major cities!

Standard Trip (7–10 Days)

Budget: $2,500–$5,000 total

- Covers two or three regions (e.g., Toronto + Niagara Falls + Ottawa).

- Includes cultural tours, nature hikes, and local dining.

- Savings Tip: Exchange CAD before arrival to avoid costly ATM fees.

Extended Trip (2–4 Weeks)

Budget: $6,000+ total

- Covers multiple provinces, including British Columbia, Alberta, Quebec, and the Maritimes.

- Best for road trips, national parks, and multi-city exploration.

- Savings Tip: Consider train or bus travel instead of domestic flights for budget-friendly long-distance transport.

Estimated Costs Per Day in Canada (Based on Travel Style)

| Expense Type | Budget Travelers ($100–$200/day) | Mid-Range Travelers ($250–$500/day) | Luxury Travelers ($800+/day) |

|---|---|---|---|

| Accommodation | Hostels, budget hotels | 3- to 4-star hotels | 5-star resorts, luxury stays |

| Food | Street food, fast food chains | Mid-range cafes, casual dining | Fine dining, high-end restaurants |

| Transport | Public transit, ride-sharing | Domestic flights, rental cars | Private chauffeurs, luxury trains |

| Attractions | Free museums, parks | Guided tours, major landmarks | VIP experiences, helicopter tours |

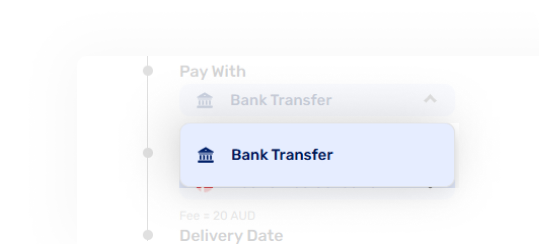

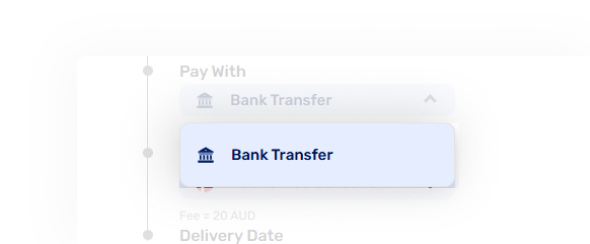

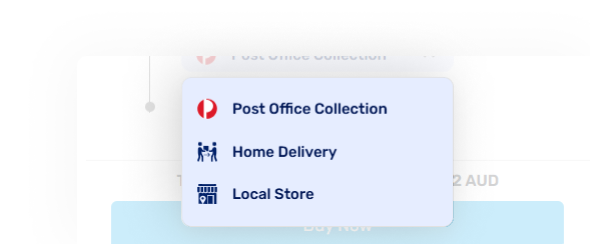

Payment Methods: Cash vs. Cards vs. Digital Payments

Canada is highly cashless, but having cash is still useful.

Tip: Most Canadian banks charge foreign transaction fees, so check with your provider before using a foreign card!

Best Places to Visit in Canada by Season

Canada’s seasonal experiences vary greatly, making each time of year uniquely special.

Spring (March–May) – Cherry Blossoms & Urban Sightseeing

Vancouver

Stunning cherry blossom season.

Ottawa

Famous Tulip Festival in May.

Quebec City

Cozy cafes and historical charm.

Spring offers mild weather and fewer crowds, making it budget-friendly!

Summer (June–August) – National Parks & Outdoor Adventures

Banff National Park

Best time for hiking & wildlife spotting.

Prince Edward Island

Scenic coastline and red sand beaches.

Toronto & Montreal

Festivals, nightlife, and vibrant summer events.

Tip: Hotels fill up fast, so book accommodations early!

Autumn (September–November) – Fall Colors & Scenic Drives

Algonquin Park

Stunning autumn foliage in Ontario.

Nova Scotia & Cape Breton

Coastal beauty with scenic road trips.

Whistler & Kelowna

Ideal for vineyard tours and mountain retreats

Tip: Fall is off-season, meaning lower hotel rates & fewer crowds!

Winter (December–February) – Ski Resorts & Holiday Festivities

Whistler & Banff

World-class skiing & snowboarding.

Montreal & Quebec City

Magical Christmas markets & winter festivals.

Yellowknife

Best time to see the Northern Lights!

Tip: Winter is ideal for holiday markets & cozy retreats, but bundle up for freezing temperatures!

- Spring

-

Spring (March–May) – Cherry Blossoms & Urban Sightseeing

Vancouver

Stunning cherry blossom season.

Ottawa

Famous Tulip Festival in May.

Quebec City

Cozy cafes and historical charm.

Spring offers mild weather and fewer crowds, making it budget-friendly!

- Summer

-

Summer (June–August) – National Parks & Outdoor Adventures

Banff National Park

Best time for hiking & wildlife spotting.

Prince Edward Island

Scenic coastline and red sand beaches.

Toronto & Montreal

Festivals, nightlife, and vibrant summer events.

Tip: Hotels fill up fast, so book accommodations early!

- Autumn

-

Autumn (September–November) – Fall Colors & Scenic Drives

Algonquin Park

Stunning autumn foliage in Ontario.

Nova Scotia & Cape Breton

Coastal beauty with scenic road trips.

Whistler & Kelowna

Ideal for vineyard tours and mountain retreats

Tip: Fall is off-season, meaning lower hotel rates & fewer crowds!

- Winter

-

Winter (December–February) – Ski Resorts & Holiday Festivities

Whistler & Banff

World-class skiing & snowboarding.

Montreal & Quebec City

Magical Christmas markets & winter festivals.

Yellowknife

Best time to see the Northern Lights!

Tip: Winter is ideal for holiday markets & cozy retreats, but bundle up for freezing temperatures!

Final Travel & Currency Tips

Conclusion

Canada offers unforgettable landscapes, vibrant cities, and seasonal adventures, and smart currency planning ensures a stress-free trip.

For the best rates and seamless transactions, visit Danesh Exchange before flying!