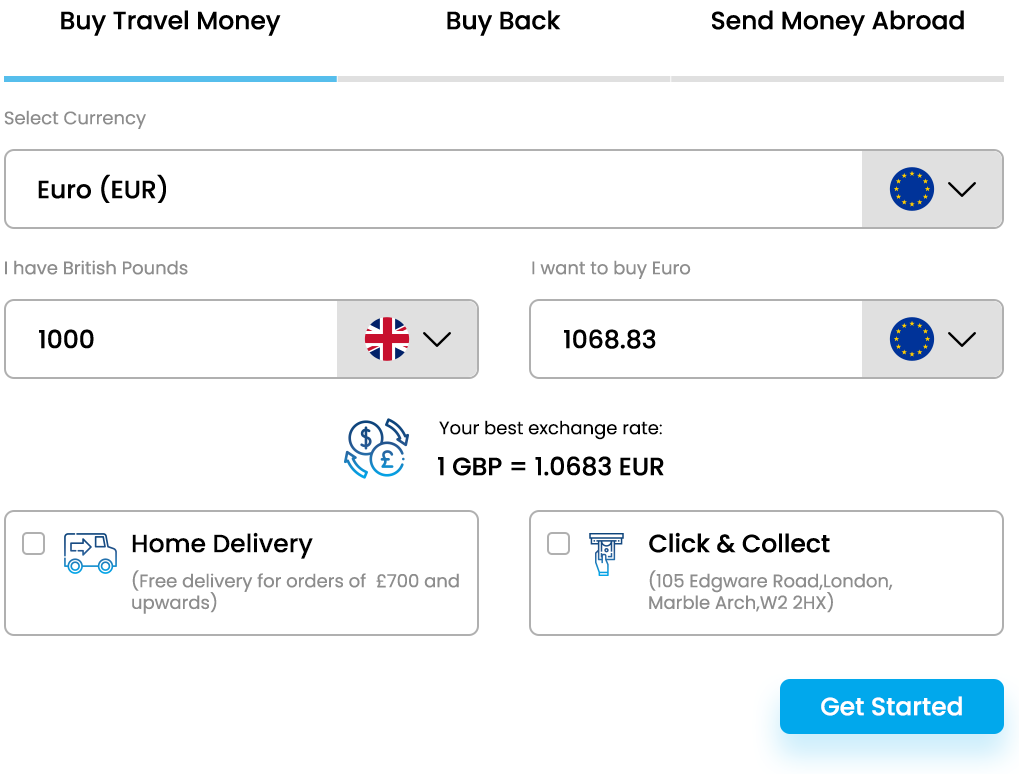

A Cheaper And Faster Way To

Send Money Abroad

Buy travel money for next day home delivery or place a click & collect

and pick up at our central London branch.

HOW DOES IT WORK?

Select the currency you wish to buy

Our rates move with the market once you confirm your order you fix your rate

Confirm your exchange rate

Our rates move with the market once you confirm your order you fix your rate

Select a delivery date

Royal Mail will require a signature from same are in the property at the time of delivery

Payment

You can get to pay via bank transfer or debit card. We can only dispatch currency once we have received cleared funds

Confirmation and tracking information

We shall mail you a dispatch notification once your currency is on its way to you and this mail will include your tracking details.

Delivery of currency

We use Royal Mail Special Delivery which is a fully insured and secure home delivery service

Buy Travel Money

The various options travellers now have when spending travel money abroad is incredibly varied from using credit cards, ATMs, travellers cheques and pre paid cards however along with them each one of them are the associated costs and fees. Once you make all those comparisons, taking travel currency away with you on holiday still comes up tops and here are the reasons why we highly recommend it!

Budgeting becomes easy

Whether you’re travelling with a bunch of friends or with family, you may wish to budget for the cost of your holiday and not find you have broken the bank balance upon your return. When you buy travel currency online, you have incorporated the cost of this and accordingly it is easier for you to keep a track of how much cash you are travel money you are spending as you physically see your foreign exchange deplete. Using credit cards abroad makes things a lot harder to keep track of what you have spent on and how much in total.

No hidden fees

Some people take a credit card when they travel abroad on business or pleasure. A card can be an easy and convenient way to pay for things but can be costly to use overseas. Credit cards charge a foreign transaction or usage fee when you spend with it abroad. The costs vary, but a fee of 3% is not uncommon for the luxury of using your card abroad and the fees can be more. So as an example, if you stay in a hotel and the bill comes to the equivalent of £200, the card company could load the cost by £7.50.

Travel Cash is accepted everywhere & anywhere you go

Whether you find yourself in the backwaters of southern India or a remote village in the Italian wine region, travel cash is widely accepted by every shop, hotel, restaurant and transport provider. You simply cannot go wrong having some travel currency on you. The convenience of having travel money in your pocket to pay for even souvenirs in markets can go a long way and don’t forget the benefit of bargaining more when you pay in cash!

Transparency on rates and the rate improves with the more you order!

Savvy travellers know that the best exchange rates are found when buying euros, buying dollars or any exotic currencies online. When purchasing travel money online, you have the luxury of seeing exactly what the rates are and any additional charges (credit card or delivery costs). Furthermore, with The Currency Club, you can even capture a better exchange rate with the more travel currency you order. For those who are fans of using the ATMs when abroad take care. The typical charge for cash withdrawals from a foreign ATM is 2.5%. In other words, withdraw £500 and the transaction cost will be £12.50 for the privilege of the withdrawal. Furthermore, in many cases the banks will not provide you with a good foreign exchange rate either, so in which case you may get stung twice.

Taking travel cash feels good and gets you in holiday mood before you’ve even reached your destination

Just like you have that buzz when you have your passport and your suitcase in hand, the joy of having some colourful foreign exchange notes in your holiday purse or wallet is like the icing on the cake! You’re off on holiday and we think simply having travel money on you makes that even more official! Get the best exchange rate to buy euros through Sterling FX’S travel money services. Register, become a member and with your own designated account, order travel money efficiently and at your convenience.

BEST CURRENCY EXCHANGE RATES

(for £1000)