Introduction

From breathtaking fjords to vibrant cities, New Zealand offers stunning landscapes, rich Maori culture, and thrilling outdoor adventures. Whether you’re hiking in Queenstown, exploring Hobbiton, or soaking in geothermal hot springs, understanding New Zealand’s currency system ensures a smooth and stress-free trip.

Before traveling, check out Danesh Exchange for competitive exchange rates on New Zealand Dollars (NZD)!

New Zealand Currency: What You Need to Know

- New Zealand uses the New Zealand Dollar (NZD), represented by $.

- Banknotes come in denominations of $5, $10, $20, $50, and $100, while coins include 10 cents, 20 cents, 50 cents, $1 (one dollar), and $2 (two dollars).

- Credit and debit cards are widely accepted, but cash is useful, especially for smaller purchases and rural areas.

Tip: Some small towns and remote attractions may not accept cards, so carry some cash for convenience.

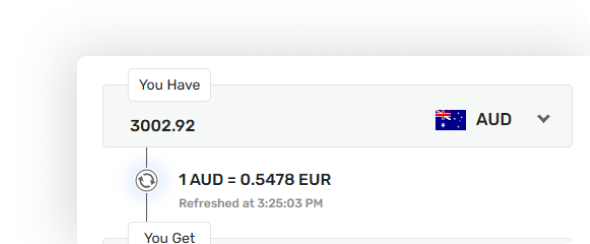

Currency Exchange in New Zealand: Where & How

Tip: Many New Zealand banks offer competitive exchange rates, but airport kiosks tend to have higher fees—exchange currency before arriving!

How Long Should You Stay & Budgeting for Your Trip to New Zealand

New Zealand offers world-class experiences, whether you’re visiting for a short trip or a full road trip adventure. Here’s what to expect:

Short Trip (3–5 Days)

Budget: $800–$2,000 total

- Best for Auckland, Rotorua, or Wellington.

- Focus on cultural sites, geothermal parks, and nature hikes.

- Savings Tip: Use public transport instead of car rentals for shorter stays.

Standard Trip (7–10 Days)

Budget: $2,500–$5,000 total

- Covers two or three regions (e.g., Auckland + Queenstown + Rotorua).

- Includes scenic drives, guided tours, and outdoor activities.

- Savings Tip: Exchange NZD before arrival to avoid costly ATM fees.

Extended Trip (2–4 Weeks)

Budget: $6,000+ total

- Covers both the North and South Islands, including Milford Sound, Abel Tasman, and Dunedin.

- Best for road trips, multi-city exploration, and adventure sports.

- Savings Tip: Campervan rentals can save costs on accommodation and transport!

Estimated Costs Per Day in New Zealand (Based on Travel Style)

| Expense Type | Budget Travelers ($100–$200/day) | Mid-Range Travelers ($250–$500/day) | Luxury Travelers ($800+/day) |

|---|---|---|---|

| Accommodation | Hostels, budget hotels | 3- to 4-star hotels | 5-star lodges, luxury stays |

| Food | Street food, budget eateries | Mid-range cafes, casual restaurants | Fine dining, gourmet meals |

| Transport | Public transit, rideshare | Domestic flights, rental cars | Private helicopters, luxury coaches |

| Attractions | Free nature hikes, parks | Guided tours, adventure sports | Exclusive retreats, VIP experiences |

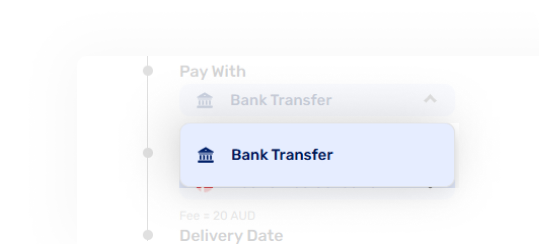

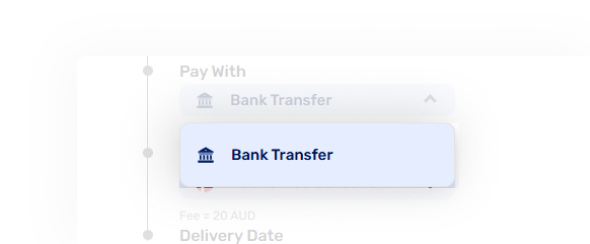

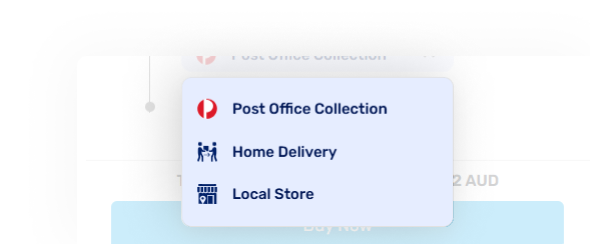

Payment Methods: Cash vs. Cards vs. Mobile Payments

New Zealand is highly cashless, but having cash is still useful.

Tip: Some remote areas lack ATMs, so it’s best to carry enough NZD in cash before heading into nature!

Best Places to Visit in New Zealand by Season

New Zealand’s seasonal experiences vary greatly, making each time of year uniquely special.

Spring (September–November) – Blooming Landscapes & Outdoor Adventures

Rotorua

Stunning geothermal parks & hot springs.

Taupo

Great time for lake cruises and waterfall hikes.

Fiordland National Park

Mild weather for Milford Sound boat tours.

Tip: Spring is ideal for nature lovers, with fewer tourists before summer arrives.

Summer (December–February) – Peak Travel Season & Beach Escapes

Bay of Islands

Tropical islands with amazing dolphin encounters.

Queenstown

Perfect for skydiving, bungee jumping & jet boating.

Nelson & Abel Tasman National Park

Pristine beaches & kayaking paradise.

Tip: Book accommodations early, as New Zealand’s summer season is peak tourism time!

Autumn (March–May) – Stunning Fall Colors & Scenic Drives

Arrowtown

Picturesque autumn foliage near Queenstown.

Hawke’s Bay

Best time for vineyard tours & wine tasting.

Tongariro National Park

Ideal for the Tongariro Alpine Crossing hike

Tip: Autumn is off-season, meaning lower hotel rates & fewer crowds!

Winter (June–August) – Ski Resorts & Snowy Adventures

Queenstown & Wanaka

World-class skiing & snowboarding.

Mount Cook National Park

Stunning glaciers & mountain treks.

Christchurch

Experience New Zealand’s winter festivals.

Tip: Winter is ideal for adventure seekers, but be prepared for cold temperatures in the South Island!

- Spring

-

Spring (September–November) – Blooming Landscapes & Outdoor Adventures

Rotorua

Stunning geothermal parks & hot springs.

Taupo

Great time for lake cruises and waterfall hikes.

Fiordland National Park

Mild weather for Milford Sound boat tours.

Tip: Spring is ideal for nature lovers, with fewer tourists before summer arrives.

- Summer

-

Summer (December–February) – Peak Travel Season & Beach Escapes

Bay of Islands

Tropical islands with amazing dolphin encounters.

Queenstown

Perfect for skydiving, bungee jumping & jet boating.

Nelson & Abel Tasman National Park

Pristine beaches & kayaking paradise.

Tip: Book accommodations early, as New Zealand’s summer season is peak tourism time!

- Autumn

-

Autumn (March–May) – Stunning Fall Colors & Scenic Drives

Arrowtown

Picturesque autumn foliage near Queenstown.

Hawke’s Bay

Best time for vineyard tours & wine tasting.

Tongariro National Park

Ideal for the Tongariro Alpine Crossing hike

Tip: Autumn is off-season, meaning lower hotel rates & fewer crowds!

- Winter

-

Winter (June–August) – Ski Resorts & Snowy Adventures

Queenstown & Wanaka

World-class skiing & snowboarding.

Mount Cook National Park

Stunning glaciers & mountain treks.

Christchurch

Experience New Zealand’s winter festivals.

Tip: Winter is ideal for adventure seekers, but be prepared for cold temperatures in the South Island!

Final Travel & Currency Tips

Conclusion

New Zealand offers stunning landscapes, vibrant cities, and exciting outdoor adventures, and smart currency planning ensures a stress-free trip.

For the best rates and seamless transactions, visit Danesh Exchange before flying!